The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity. It is a measure of the degree to which a company is financing its operations with debt rather than its own resources. The debt-to-capital ratio is one of the more meaningful debt ratios because it focuses on the relationship of debt liabilities as a component of a company’s total capital base.

Types of Leverage Ratios

From Year 1 to Year 5, the D/E ratio increases each year until reaching 1.0x in the final projection period. Upon plugging those figures into our formula, the implied D/E ratio is 2.0x. It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more.

Calculation (formula)

Retained earnings represent the portion of a company’s net income that is not distributed as dividends and is instead kept in the company’s reserves. If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk. There also are many other metrics used in corporate accounting and financial analysis used as indicators of financial health that should be studied alongside the D/E ratio.

Debt to Equity Ratio Formula & Example

- This is in contrast to a liquidity ratio, which considers the ability to meet short-term obligations.

- Understanding how debt amplifies returns is the key to understanding leverage.

- Generally, a ratio below 1 is considered safer, while a ratio above 2 might indicate higher financial risk.

- Some economists have stated that the rapid increase in consumer debt levels has been a contributing factor to corporate earnings growth over the past few decades.

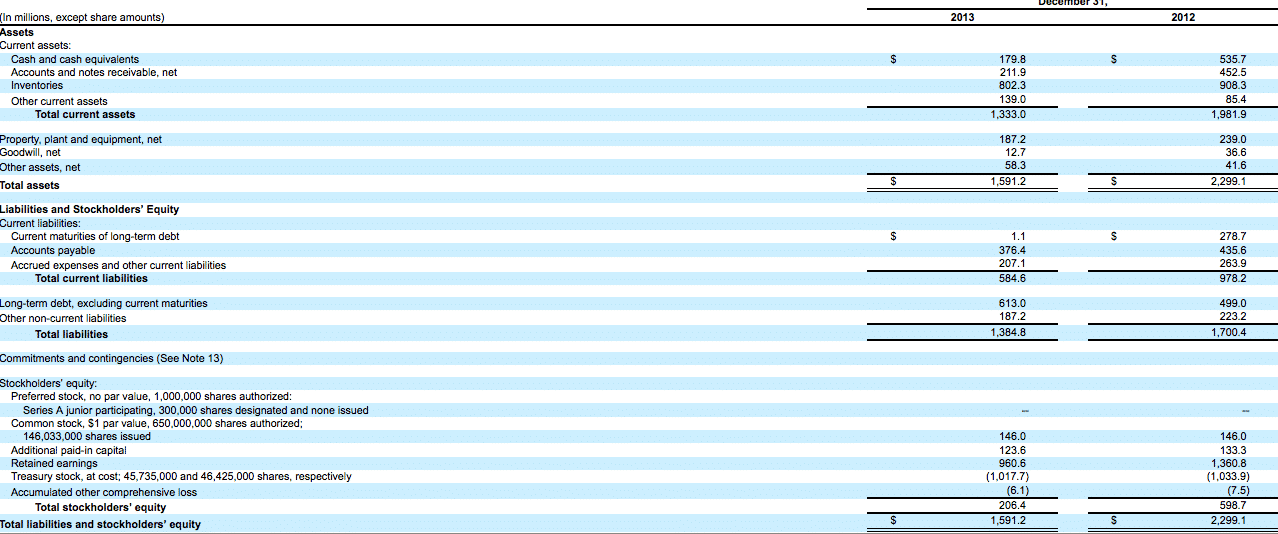

- Most of the information needed to calculate these ratios appears on a company’s balance sheet, save for EBIT, which appears on its profit and loss statement.

If a company has a negative D/E ratio, this means that it has negative shareholder equity. In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection. What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky.

Keep reading to learn more about D/E and see the debt-to-equity ratio formula. The interest paid on debt also is typically tax-deductible for the company, while equity capital is not. A company that does not make use of the leveraging potential of debt financing may be doing a disservice plain english accounting to the ownership and its shareholders by limiting the ability of the company to maximize profits. Ultimately, the D/E ratio tells us about the company’s approach to balancing risk and reward. A company with a high ratio is taking on more risk for potentially higher rewards.

It’s useful to compare ratios between companies in the same industry, and you should also have a sense of the median or average D/E ratio for the company’s industry as a whole. However, if that cash flow were to falter, Restoration Hardware may struggle to pay its debt. Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going. For example, Company A has quick assets of $20,000 and current liabilities of $18,000. The cash ratio compares the cash and other liquid assets of a company to its current liability. This method is stricter and more conservative since it only measures cash and cash equivalents and other liquid assets.

However, industries may have an increase in the D/E ratio due to the nature of their business. For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies. Basically, the more business operations rely on borrowed money, the higher the risk of bankruptcy if the company hits hard times.

While this can lead to higher returns, it also increases the company’s financial risk. When evaluating a company’s debt-to-equity (D/E) ratio, it’s crucial to take into account the industry in which the company operates. Different industries have varying capital requirements and growth patterns, meaning that a D/E ratio that is typical in one sector might be alarming in another.

A low D/E ratio shows a lower amount of financing by debt from lenders compared to the funding by equity from shareholders. Lenders and investors perceive borrowers funded primarily with equity (e.g. owners’ equity, outside equity raised, retained earnings) more favorably. So, the debt-to-equity ratio of 2.0x indicates that our hypothetical company is financed with $2.00 of debt for each $1.00 of equity.

Total assets have increased to $1,100,000 due to the additional cash received from the loan. However, it is important to note that financial leverage can increase a company’s profits by allowing it to invest in growth opportunities with borrowed money. So, a company with low debt-to-equity ratio may be missing out on the potential to increase profits through financial leverage. A low debt-to-equity ratio does not necessarily indicate that a company is not taking advantage of the increased profits that financial leverage can bring. The debt-to-equity ratio (D/E) is a financial ratio that indicates the relative amount of a company’s equity and debt used to finance its assets. In general, a lower D/E ratio is preferred as it indicates less debt on a company’s balance sheet.